1. Chase Bank

* Wide range of business banking products and services

* Dedicated restaurant banking team

* Mobile and online banking with advanced features

* Higher fees compared to some other banks

* May require higher minimum balances for certain accounts

2. Wells Fargo

* Extensive branch network for in-person support

* Variety of loan options for restaurant businesses

* Merchant services and payment processing

* Recent controversies and scandals may impact reputation

* Fees can be higher for smaller businesses

3. Bank of America

* Large national bank with a strong reputation

* Business checking accounts with competitive rates

* Access to a wide range of financial services

* May not offer as many specialized restaurant banking services as other banks

* Fees can vary depending on account type and location

4. PNC Bank

* Focus on small business banking

* Restaurant-specific loan programs

* Mobile banking with advanced features

* Limited branch network outside of certain regions

* Fees may be higher for non-PNC customers

5. U.S. Bank

* Strong customer service and support

* Variety of business banking accounts and loans

* Mobile and online banking with user-friendly interface

* May not offer as many specialized restaurant banking services as other banks

* Fees can vary depending on account type and location

Factors to Consider When Choosing a Bank for Your Restaurant Business:

DISCLAIMER: This information is provided for general informational purposes only, and publication does not constitute an endorsement. Kwick365 does not warrant the accuracy or completeness of any information, text, graphics, links, or other items contained within this content. Kwick365 does not guarantee you will achieve any specific results if you follow any advice herein. It may be advisable for you to consult with a professional such as a lawyer, accountant, or business advisor for advice specific to your situation.

today

Copyright © 2025 Kwick365.com

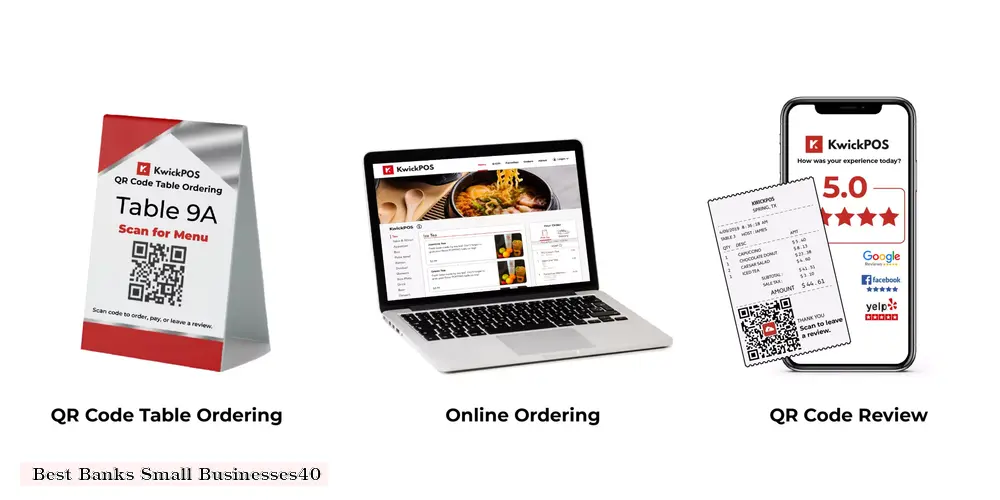

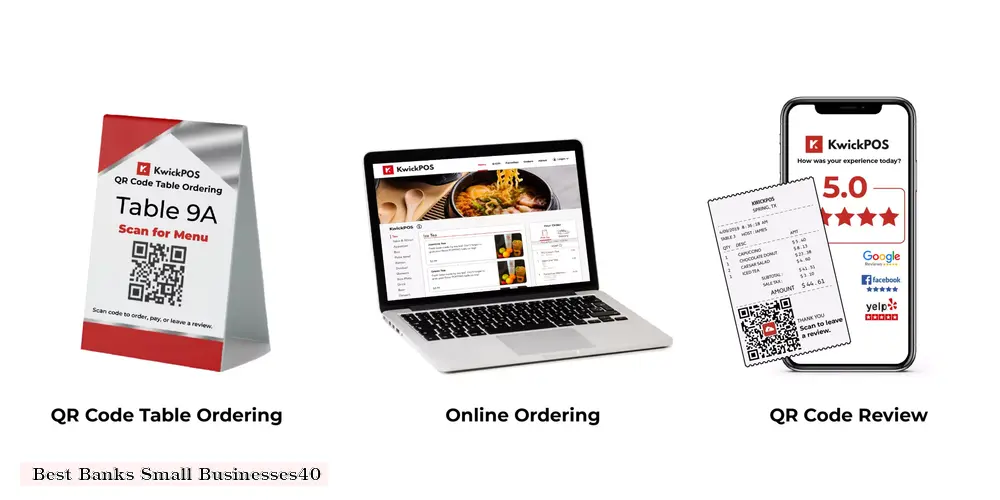

Designed by KwickPOS is the best restaurant POS