Best Restaurant Payroll Software: A Comprehensive Guide

Introduction

Payroll management is a crucial aspect of any restaurant business. With the right payroll software, you can streamline the process, ensure accuracy, and comply with labor laws. This guide will provide an in-depth analysis of the best restaurant payroll software options available, helping you make an informed decision for your business.

Key Features to Consider

When selecting restaurant payroll software, consider the following key features:

Employee Management

Ability to track employee information, including hours worked, pay rates, and deductions.Payroll Processing

Automated calculation of wages, taxes, and deductions, with support for multiple pay schedules.Tax Compliance

Compliance with federal, state, and local tax regulations, including automatic tax calculations and reporting.Reporting and Analytics

Comprehensive reporting capabilities, including payroll summaries, tax reports, and employee earnings statements.Integration

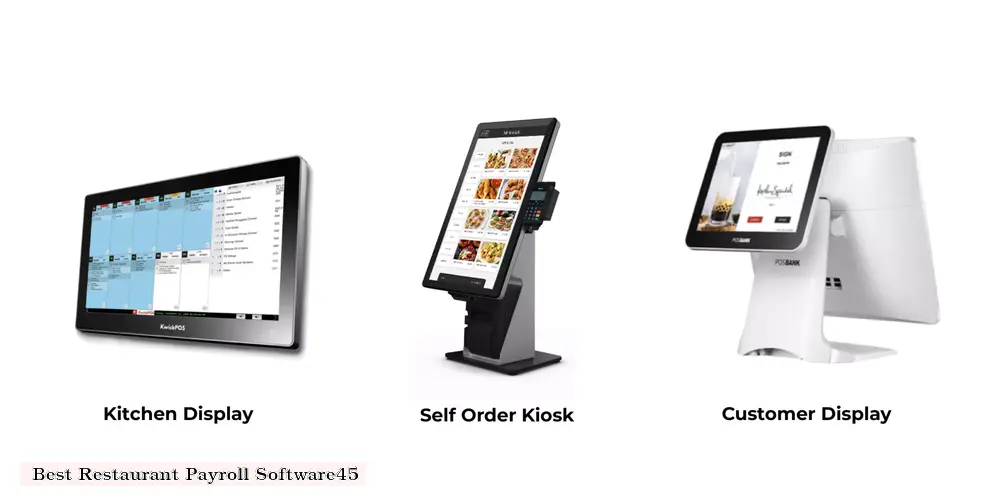

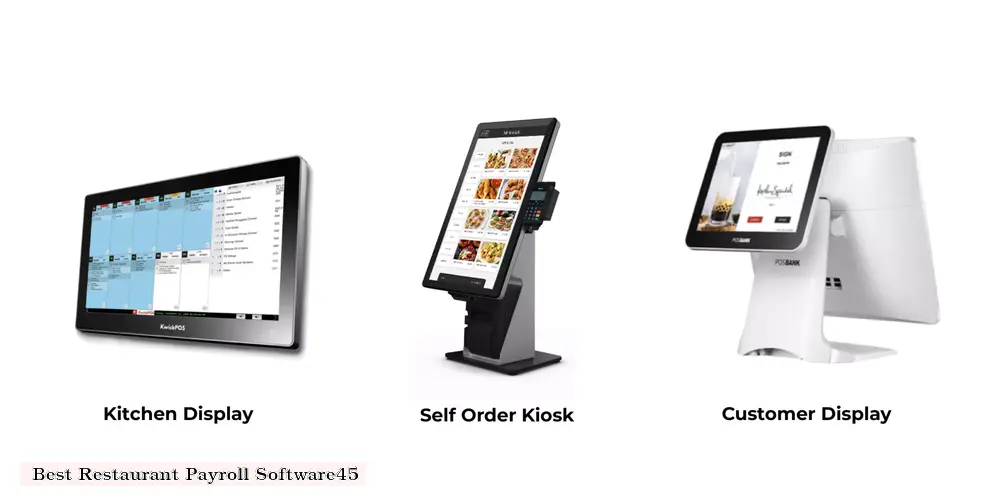

Seamless integration with other restaurant management systems, such as POS and timekeeping software.Mobile Accessibility

Ability to access payroll information and process payroll on the go.Customer Support

Responsive and knowledgeable customer support to assist with any issues or inquiries.Top Restaurant Payroll Software Options

Based on these key features, here are the top restaurant payroll software options:

1. Gusto

Pros

User-friendly interface, comprehensive employee management, automated payroll processing, tax compliance, and excellent customer support.Cons

May not be suitable for very large restaurants with complex payroll needs.2. Paychex Flex

Pros

Robust payroll processing capabilities, customizable reporting, integration with timekeeping systems, and dedicated HR support.Cons

Can be more expensive than other options, especially for small businesses.3. ADP Workforce Now

Pros

Scalable solution for businesses of all sizes, advanced employee management features, mobile accessibility, and integration with other ADP products.Cons

Can be complex to set up and use, especially for non-technical users.4. QuickBooks Payroll

Pros

Integration with QuickBooks accounting software, easy-to-use interface, automated payroll processing, and tax compliance.Cons

Limited employee management capabilities and may not be suitable for restaurants with complex payroll needs.5. Rippling

Pros

Modern and intuitive interface, comprehensive employee management, automated payroll processing, tax compliance, and integration with other HR tools.Cons

May not be as feature-rich as some other options, especially for larger restaurants.Choosing the Right Software

The best restaurant payroll software for your business will depend on your specific needs and budget. Consider the following factors:

Size of your restaurant

Larger restaurants may require more advanced features and scalability.Complexity of your payroll

Restaurants with multiple pay schedules, overtime calculations, or complex deductions may need more robust software.Budget

Determine the cost of the software and any additional fees or support services.Integration

Ensure the software integrates seamlessly with your existing restaurant management systems.Customer support

Choose software with responsive and knowledgeable customer support to assist with any issues or inquiries.Conclusion

Choosing the right restaurant payroll software can significantly streamline your payroll process, ensure accuracy, and comply with labor laws. By carefully considering the key features and top options outlined in this guide, you can make an informed decision that will benefit your business and employees.

DISCLAIMER: This information is provided for general informational purposes only, and publication does not constitute an endorsement. Kwick365 does not warrant the accuracy or completeness of any information, text, graphics, links, or other items contained within this content. Kwick365 does not guarantee you will achieve any specific results if you follow any advice herein. It may be advisable for you to consult with a professional such as a lawyer, accountant, or business advisor for advice specific to your situation.